Disruption is the new normal in retail

Over the last decade, the traditional retail model has been challenged by an unprecedented wave of change. These changes were so rapid and recurrent that it exposed its weak points, namely retail’s inability to adapt to omnichannel retail, faster fashion, and vertically-integrated business channels.

Today, this disruption is coming at an accelerated speed and it’s bound to get faster as consumer expectations rise. Technological advances driven by empowered consumers will continue to shake the foundation of the retail model, leaving some retailers to play catch-up, while more forward-thinking businesses will lead this new wave of change.

These shifts in the market are forcing retailers to question the long term viability of the increasingly ineffective traditional retail model. To keep from falling behind, retailers must re-evaluate their entire enterprise and the technologies that support them and dramatically alter their business model to compete in the new marketplace.

Omnichannel Isn’t The Future, It’s Already Here

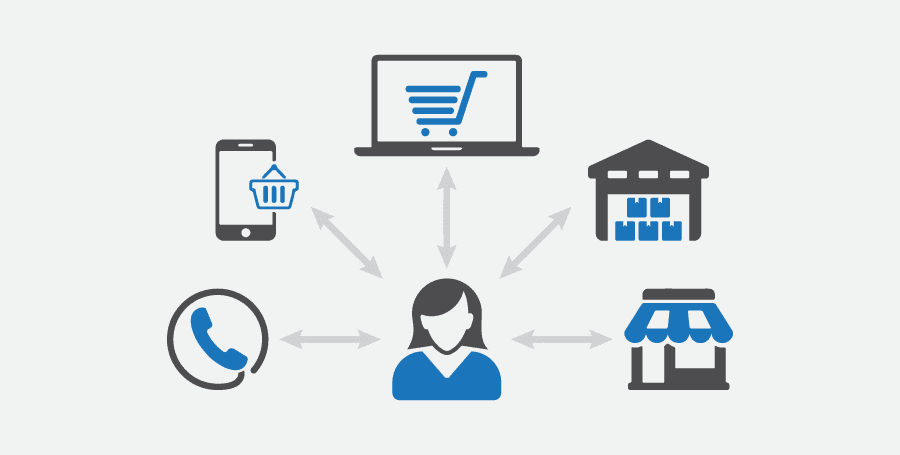

We are currently living in the age of the informed customer, where mobility, social media and e-commerce tools have empowered customers to easily browse, compare prices and shop – whenever and where they want.

One of the main reasons for this change is the demise of channelization in the shopping journey. As mobile commerce comes of age and the line between online and physical space blurs, consumers are no longer shopping sporadically. Instead, they are always shopping.

This metamorphosis in retail is not a linear path— pulling away from brick-and-mortar and moving toward online retail —but rather a combination of the two. This has led to the global trend of omnichannel, which has become the most strategic hallmark of the new customer-driven retail industry.

Yet, the reality is omnichannel is no longer a concept or an emerging trend that retailers should look forward to – it is already taking control of the industry.

For proof of the enormity and widespread adoption of this trend, look at brands such as Burberry, Gucci and Oasis. All of them are changing their business models to compete better.

Burberry Transforms

For instance, Burberry completely transformed their business from their technology all the way down to the interactive in-store video projections. The brand redefined their in-store experience by arming sales associates with customer information on iPads. They are one of the few luxury brands offering in-store pickup of online purchases. When multiple channels converge it’s an indication of omnichannel done right.

Nevertheless, the majority of retailers underestimate the impact of this new omnichannel environment. In a recent Forbes survey, only 34% of CEOs considered the rise of omnichannel shopping to be an external threat. Only 22% said it would impact their organization.

This survey brings to light an alarming reality. Retailers lack the understanding of how omnichannel impacts a business. The absence of strategic planning for a foregone trend, especially since the growth of omnichannel retail is one of the most fundamental shifts that has occurred in recent times.

This means that a startling number of retailers are in danger of missing the mark when it comes to adapting to this market reality and priorities related to the new customer-driven retail model, such as optimizing supply chain responsiveness and accelerating time to market will comparatively wind up less important.

How Prepared Are Retailers for this Change?

There are a number of reasons why fashion businesses are not up to the challenge. The biggest contributor is the use of multiple systems.

Vertically-integrated retailers are riddled with outmoded, disparate systems that weaken their ability to adapt. These siloed systems create barriers across cross-channel operations (from sourcing and procurement to merchandising), and across channels (e-commerce, stores, distribution centers), resulting in deteriorated brand experiences.

Retailers who manage their e-commerce and in-store inventories separately are now plagued with an overwhelming volume of data. This becomes a challenge when each system stores data in a different format. Combining the data takes too long to be useful, hampering a retailer’s ability to respond to conditions and trends that impact their business.

Integration Is Key to a Responsive Operating Model

To prepare for the new future of retail, retailers need to use the right technology and practice ‘real-time retail’ that aligns the supply chain with consumer demand.

This means that retailers must look to integrate their operations across their fashion value chain, from their wholesale business to their retail stores. They need to establish a proactive, agile and responsive operating model. This helps to deliver a synchronous experience that is intuitive, contextual, and personalized.

Integration will break down any silos between sourcing, merchandising, and logistics. It will enhance collaboration across the supply chain to meet faster fashion demands.

SAP, along with Rizing, released a solution to address this need with the launch of the Fashion Management Solution.

Enabling this change requires a shift in a retailer’s business priorities, along with a clear understanding that a consumer-aligned supply chain is imperative to survive and grow in the industry.

By synchronizing across the value chain, tomorrow’s world will be dominated by fashion businesses that align their entire demand and supply chain to consumer expectations. At the same time, they will establish an omnichannel connection with shoppers and empower their associates to be better.

It’s this effective orchestration of the value chain that will be the differentiator between competing businesses in the coming decade.